Receive tax credits for your donation.

Support Northstar and receive state tax credits with the Neighborhood Assistance Act Tax Credit Program for Education (NAP) or Education Improvement Scholarships Tax Credit Program (EIS).

What is NAP and EIS?

The Neighborhood Assistance Act Tax Credit Program (NAP) and the Education Improvement Scholarships Tax Credit Program (EIS) are programs administered by the Virginia Department of Education that allow businesses and individuals to receive state tax credits for supporting approved charities like Northstar. Your gift ensures Northstar’s ability to provide each student with an exceptional, customized education.

Why should I give to Northstar for tax credits?

- You can use your NAP or EIS tax certificate for up to 5 years after your initial donation.

- You can give a variety of gift types, including cash donations, real estate, and marketable securities.*

- Gifts made by end of calendar year (December 31, 2023) can be used on your 2023 taxes.

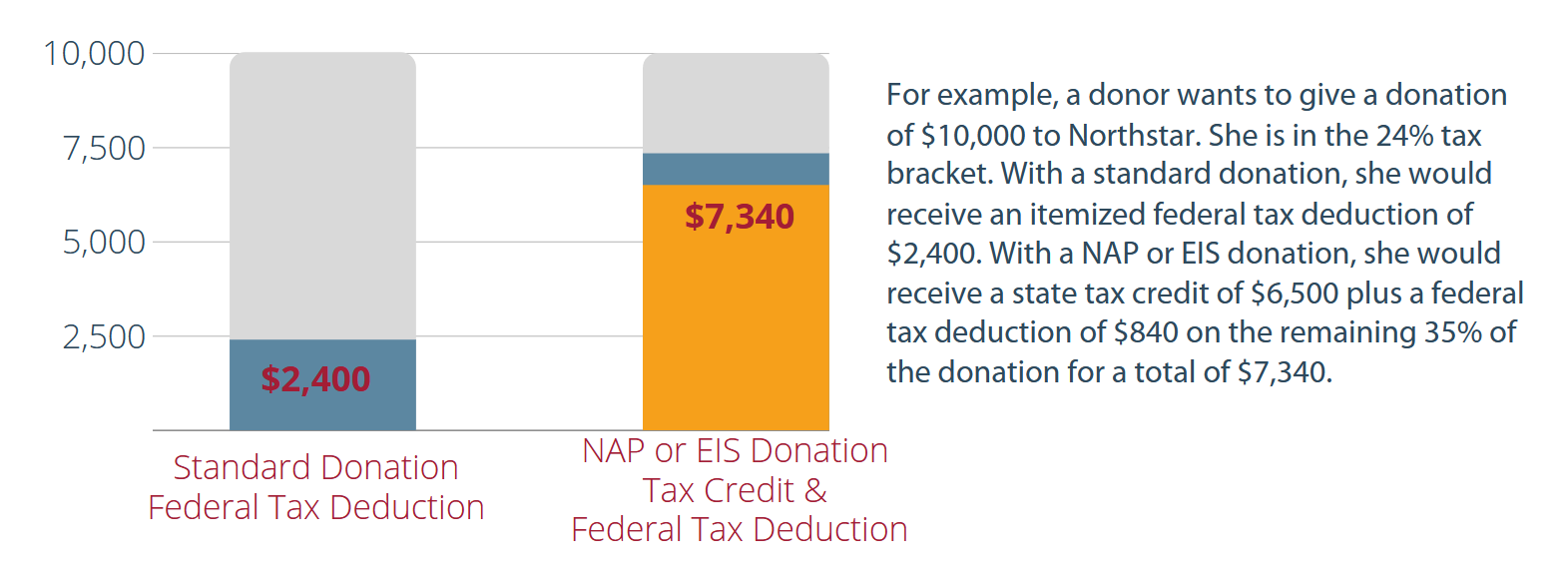

- Northstar allows NAP and EIS donors to take the maximum credit amount of 65%.

*Gifts of securities may receive additional benefits due to capital gains tax laws.

How do I take advantage of the program?

NAP and EIS credits are given on a first-come, first-serve basis. We are allocated a limited amount of NAP tax credits each year, and our EIS tax credits are dependent upon the number of qualifying students enrolled at Northstar. Contact Maggie Latimer at mlatimer@northstarva.org or call 804-747-1003 today so that your credits can be reserved. Once your credits are reserved, we will walk you through the process of making your donation. Thank you so much for your support of Northstar!

Information presented here is not intended to provide, and should not be relied on for tax, legal, or accounting advice. Please consult your independent tax advisor before engaging in any transactions. Please note that gifts made through donor-advised funds are not eligible for tax credits.